First of all, Thank you to the American Chamber of Commerce HK on their Friday talk on the future of supply chain, definitely an issue long overdue for review and one who’s urgency was accelerated by the events of 2020 and COVID-19.

For those who read my last article – The Continual Impact of Covid-19 On Global DTC & Ecommerce Logistics, today is a deeper dive to help you understand what’s happening behind the scenes in the supply chain, ocean freight and US ports spaces that accumulated in the existing bottlenecks. In addition, I’ll provide the latest update on the freight and port situation as of April 2021.

Let’s Get Started.

OCEAN FREIGHT – WHAT’S CAUSING THE DELAY & INCREASE IN SHIPPING COST

Q1 & Q2 of 2020 saw a significant drop in ocean freight due to the immediate shutdown of China and hence, the shutdown of raw materials supply coming whilst Q3 saw a significant rebound and a surge in ecommerce expenditure, largely motivated by the consumer spending shift away from travel and entertainment to consumer goods and in part attributed to government stimulus.

As a result of the sudden shift, carriers switched on more capacity to meet the surge in volume.

Globally, the supply of vessels from Q3 2020 increased by 4%, with the global idling rate (% of ships not sailing due to repairs) sitting at 1.5%, statistically, this signifies that ocean freight is at full capacity. For global carriers such as Maersk, every ship and container available was activated and deployed, but the surge in demand led to chartering of more ships and orders of more containers.

To meet the trans pacific supply and demand, COVID-19 also introduced a new mode of fast sailing, that enabled a trans pacific crossing to be done in 11 days, however, landside disruptions caused by COVID-19, with testing regulations for trucking and port operations and COVID clusters in ports meant though crossings were completed in 11 days, the ships at Port of LA sat at berth awaiting unloading for another 11 days. The ripple effect of slower unloading times also led to a slower return to manufacturing origin speed for containers, starting the current vicious cycle of container shortages and shipping delays.

For US Ports, the bullwhip effect of retailers trying to estimate demand during the pandemic, compounded by China manufacturing delay (both COVID and Chinese New Year influenced), labour scarcity in US ports, and geographically moving cargo through LA which in standard operations is the fastest port, resulted in the congestions that we are witnessing in Ports of LA.

OCEAN FREIGHT – WHAT Q2 & Q3 2021 LOOK LIKE

Conditions in the major east/west trades remain as critical as they’ve been since the onset of the global pandemic.

The transpacific market is expected to be sustained all the way through the traditional holiday/back to school peak season (A conservative estimation put this at Q3 2021, but again, that’s a BIG IF).

Primary factors contributing to the on-going supply chain bottleneck include:

- Vessels out of Asia still remain completely oversubscribed.

- There is little new or additional capacity being introduced into the east/west container trade lanes

- Overall U.S. consumer demand shows no sign of slowing all the way into Q3 (Ecommerce increased 6% from February and 28.7% yoy)

- The container shortage crisis in Asia has worsened since the Suez Canal incident.

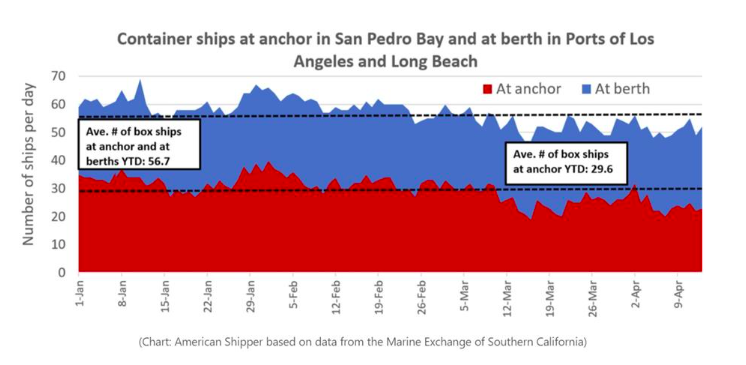

- Minimal progress has been made in clearing out the backlog of containerships at anchor at the ports of Los Angeles/Long Beach (see graph below)

One of the few bright spots among the many supply chain choke points is the increase in west coast port labor. Employers and the International Longshore & Warehouse Union (ILWU) & the west coast port labor union have made significant progress in mitigating the labor shortage that has hampered cargo handling since late 2020.

Longshoremen at the ports of Los Angeles and Long Beach are working more than 43,000 individual shifts each week, up from about 27,000 individual work shifts each week in July 2020. This will likely help to reduce the number of containerships currently at anchor (see below latest update), as long as rail lines remain fluid.

LONG AND SHORT TERM IMPACT OF COVID-19 ON US ECOMMERCE SUPPLY CHAINS

From now until the end of 2021, the acceleration of global COVID-19 vaccination program and the implementation of travel bubbles will lead to a shift in consumer spending away from FMCG and towards the travel industry. This shift in consumer spending pattern will lead to two outcomes, air travel, hence commercial cargo space will increase, hence relieving the pressure on air freight cost. Secondly, moving consumer spending to production light industries reduces the pressure on production, with a flow on effect of lowering demand on ocean freight with potential reduction of ocean freight costs.

The long term question ecommerce supply chains need to ask centres on cost and diversification. From a manufacturing cost POV, China’s 5 year economy plans transitioning from an agrarian to intellectual/professional foundation has led to a steady rise in manufacturing & labour costs. Consequentially, this has motivated ecommerce brands to look beyond China and at cheaper frontier countries in South East Asia such as Vietnam and Bangladesh.

The fuel that has accelerated a shift from China was COVID-19. The pressure of putting all your manufacturing eggs into one China basket was actualised during China’s initial COVID-19 shutdown. Diversification of the production capacity, through employment of additional countries has the potential to hedge the risk of overreliance on one manufacture origin by running production supply chain in multiple countries, in parallel.

Whilst the trade war and COVID-19 has made Vietnam a benefactor, certain macroeconomics bottlenecks the country’s ability to rival China as a manufacturer competitor. The biggest pain point lies in its population, currently 14x smaller than China, meaning that the risk of labor shortage is much higher whilst the pool of human capital are at present, lower.

This leads to the hypothesis that a mass ecommerce exodus from China is unlikely, with Vietnam currently comprising 0.27% of the global manufacturing output, compared to China’s 28.22%, but ecommerce brands will continue to diversify their operations into other parts of Asia to mitigate the impact of the trade dispute and COVID-19.

Ready To Upgrade Your Logistic Solution?

Speak to Floship ecommerce logistic consultant about improving your global support chain today